*NEW* You can donate Cryptocurrency to Home of Hope now!

To donate Crypto, click on button below, fill out the information and use the QR code given to give from your crypto wallet. Contact us if you need any assistance.

We recommend: Talk to your investment broker about this page!

1. Donate Shares or Units In-Kind

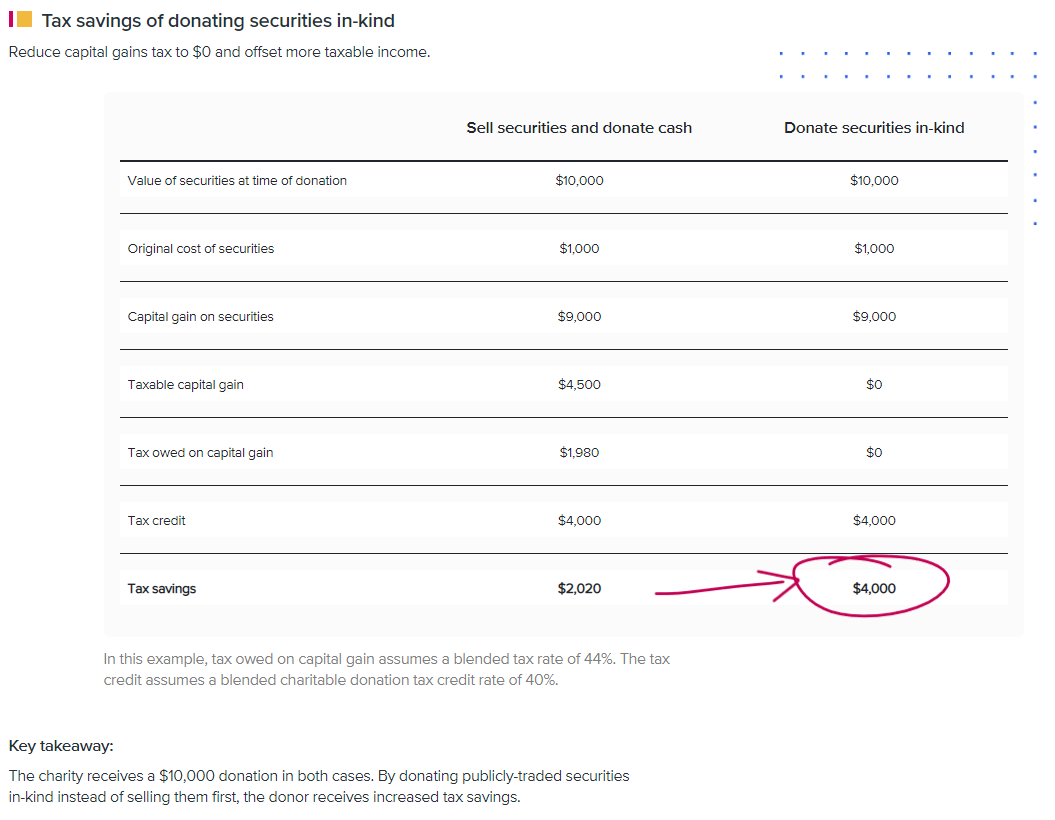

(Investments, Stocks, Bonds, non-registered Mutual Funds and segregated funds) By donating appreciated shares, you can give more and pay less tax at the same time!

TRIPLE THE BENEFITS!

- Pay NO TAX on the growth of your investment.

- Get the full tax benefit. The charity gives you a donation receipt at the end of the year for income tax credit.

- Donated shares are exempt from any Capital Gains.

It's EASY!

Fill out the form below (or have your financial advisor do it for you) and sign your donation over to Home of Hope. If you are not sure what a brokerage account is then checking out sites like SoFi can help you with that type of information.

FORM: Donate Securities IN-KIND

Read what CRA has published about it.

Watch this 15-second explanation video:

EXAMPLE:

STANDARD DONATING: Susan purchased shares in ABC Co. Ltd. in 2003 for $5000. Today the shares have a fair market value of $10,000. If Susan sells the shares (assuming she is in a 32% tax bracket) she would pay taxes of $800, enabling her to make a cash donation of $9,200 and a reduction of income taxes owing of $4550.

ENHANCED DONATING: If Susan gives the stocks directly to Home of Hope, they receive a donation of $10,000 and Susan has a donation receipt for $10,000 resulting in a reduction in taxes owing of $4950. Also, she is not charged with any Capital Gains.

1b. Real Estate

ALSO, now if you donate a portion of the proceeds of the sale of real estate to a registered charity within 30 days of the sale, there is a 0% inclusion rate on the amount donated (No Capital gains on that portion) but you still get the full donation credit.

2. Honour & Memorial Giving

We never forget the special people who've touched our hearts and made a difference in our lives.

By making a gift to honour someone important to you or to preserve the memory of a loved one who has passed away, you, too, will be making a difference - in the lives of children around the world. Each donation over $15 is tax-deductible.

3. Consider adding Home of Hope to your Will

This is a great idea, but it is important that you talk to your lawyer, broker or financial advisor before doing this. According to this article, life insurance can be a sensible way to make a valuable legacy gift and you could donate a portion of your life insurance.

- If you name a charity as an irrevocable beneficiary, the premiums give you a tax credit now.

- The charity benefits when the person passes away by receiving the death benefit.

- The portion % desired to be donated can go straight from the insurance company to the charity and avoid Capital Gains and taxes.

**Before making a standard donation to Home of Hope, we recommend that you consider the amazing benefits of giving from an investment account instead.**

Why Donate?

Integrity. Trustworthy. PROVEN.

These are important traits for us and we will continue to strive for excellence and helping more and more children every year.

Another reason? Low administration fees. Find out more -->